Introduction

Algorithmic trading and artificial intelligence (AI) have become the central engines of modern capital markets. They execute orders at unprecedented speed, detect market signals invisible to human traders, and optimize portfolio strategies through machine learning, reinforcement learning, and neural network–driven predictions. This “Alpha Generation Engine”—the combined ecosystem of algorithms, data pipelines, execution systems, and self-learning models—now drives a substantial percentage of global market volume.

While these systems enhance liquidity, reduce spreads, and generate sophisticated risk-adjusted returns, their growing dominance introduces systemic risks that regulators, market participants, and policy institutions are still struggling to understand. AI models interacting with each other across fragmented markets, high-frequency systems acting on millisecond signals, and autonomous portfolio machines dynamically reallocating capital all create complex feedback loops that can amplify volatility, distort price discovery, and accelerate contagion across asset classes.

This article provides a structured, 1500-word analysis of the systemic risks emerging from the Alpha Generation Engine, organized with SEO-optimized H1, H2, and H3 tags.

Understanding the Alpha Generation Engine in Modern Markets

What Is the Alpha Generation Engine?

The “Alpha Generation Engine” refers to the integrated architecture of AI-driven trading systems, quantitative models, execution algorithms, and data-centric infrastructure that collectively pursue market outperformance. It encompasses:

-

High-frequency trading systems

-

Machine learning forecasting models

-

Statistical arbitrage engines

-

AI-driven market-making bots

-

Smart order routing and execution algorithms

-

Autonomous portfolio optimization systems

These components ingest vast quantities of real-time and alternative datasets—order books, tick-by-tick price feeds, satellite imagery, social sentiment, credit card transaction patterns—and convert them into actionable trading signals.

How Algorithms and AI Rewired Market Microstructure

Over the last decade, markets have shifted from human-driven to machine-dominated microstructure. Key changes include:

-

Predominance of sub-second trading

-

Fragmentation across dark pools, lit venues, and alternative trading systems

-

Increased automation of liquidity provision

-

Reinforcement learning models optimizing execution paths in real time

These developments created more efficient markets but also added opaque layers of machine-to-machine interaction that regulators cannot easily observe.

The Systemic Risk Landscape: Core Vulnerabilities in AI-Driven Markets

1. Feedback Loops Amplified by Machine Learning

Machine-learning trading models often use similar inputs, techniques, and backtested signals. When multiple algorithms detect the same pattern and respond simultaneously, markets experience synchronized movement. This can create:

-

Reinforcing volatility surges

-

Rapid liquidity extraction

-

Cascading liquidation events

The “herding effect” once attributed to human traders is now significantly magnified by machines optimizing for the same signals at comparable speeds.

2. Flash Events and Ultra-Fast Liquidity Migration

AI and high-frequency trading systems react in microseconds. When volatility spikes or uncertain data feeds emerge, algorithms can instantly withdraw liquidity. Historical episodes include:

-

Flash crashes

-

Sudden ETF decoupling

-

Treasury market dislocations

-

Unexpected cross-asset correlations

These events demonstrate how the Alpha Generation Engine can accelerate price swings long before human intervention is possible.

3. Model Convergence and Homogeneity of AI Systems

As financial institutions adopt similar ML architectures, training datasets, and hyperparameter optimization techniques, the diversity of decision-making shrinks. Systemic homogeneity leads to:

-

Similar risk allocations across asset classes

-

Uniform stop-loss triggers

-

Correlated factor exposures

-

Simultaneous de-risking during stress

Homogeneous models reduce the resilience of markets and heighten systemic fragility.

4. Opacity and Explainability Challenges

Many advanced models—particularly deep learning systems—operate as “black boxes.” Their decision-making is often:

-

Non-linear

-

Non-transparent

-

Impossible to fully explain in real time

Opacity complicates risk management, supervisory oversight, and post-event attribution. When a trading model misbehaves, diagnosing the root cause can be extremely difficult.

5. Data Quality and Adversarial Vulnerabilities

The Alpha Generation Engine is only as strong as its data inputs. Data-related risks include:

-

Feed interruptions

-

Latency mismatches

-

Erroneous ticks

-

Malicious spoofing

-

Adversarial manipulation of alternative datasets

If corrupted data flows into a live AI model, it can generate distorted trading signals that propagate across markets.

6. Regime Shifts That Break Historical Models

Machine learning relies heavily on past data. When markets experience structural regime shifts—geopolitical shocks, pandemics, new monetary policy frameworks—models trained on historical patterns can misfire. This creates:

-

Sudden loss of predictive power

-

Miscalibrated risk models

-

Unexpected algorithmic behavior

Markets dominated by models that fail simultaneously face severe systemic stress.

The Role of AI in Liquidity Provisioning and Market Stability

AI Market Makers: Benefits and Risks

AI-driven market makers supply significant intraday liquidity, reducing spreads and supporting efficient price discovery. However, their liquidity is highly reactive. In stressed environments, they tend to:

-

Widen spreads rapidly

-

Withdraw quotes

-

Increase cancellation rates

-

Abandon certain assets entirely

This behavior can convert localized stress into market-wide instability.

Cross-Asset Contagion Driven by Automated Hedging

Many institutions now use AI systems to manage cross-asset hedges automatically. When one asset’s volatility spikes, algorithms may execute synchronized hedging flows across:

-

Equities

-

Rates

-

FX

-

Commodities

-

Crypto

This automated contagion mechanism can reinforce shocks rather than absorb them.

Supervisory and Regulatory Challenges

Difficulty Monitoring Machine-to-Machine Markets

Traditional regulatory frameworks were built for human traders. Today, supervisors must oversee:

-

Nanosecond-level trading patterns

-

Complex algorithmic routing decisions

-

Adaptive AI learning cycles

-

Opaque black-box architectures

Existing surveillance tools are insufficient for real-time machine-to-machine interactions.

Lack of Standardized AI Governance

There is no unified framework governing:

-

Model validation

-

Algorithmic accountability

-

Training dataset transparency

-

Continuous supervision of autonomous systems

This fragmentation leaves significant blind spots.

Global Regulatory Fragmentation

Markets increasingly depend on cross-border algorithmic liquidity. But regulatory regimes differ widely across regions, creating patchwork oversight that cannot easily prevent systemic cascades.

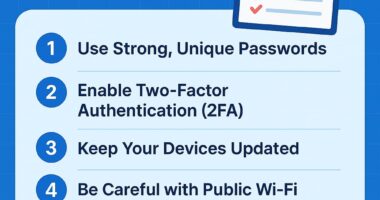

Strategies to Mitigate Systemic Algorithmic and AI Risk

1. AI Model Governance and Auditing

Institutions must adopt structured frameworks for:

-

Model explainability

-

Bias detection

-

Scenario testing

-

Black-box auditing

-

Ethical AI ceilings

Robust governance reduces the risk of unexpected algorithmic behavior.

2. Real-Time Market Infrastructure Monitoring

Regulators should deploy real-time sensors capable of monitoring:

-

Order book dynamics

-

Algorithmic routing behavior

-

Latency distortions

-

Liquidity evaporation signals

Enhanced telemetry enables faster intervention during anomalies.

3. Diverse Model Architectures

Encouraging heterogeneity in:

-

Datasets

-

Modeling techniques

-

Execution strategies

-

Risk factor exposures

can reduce synchronized failure pathways.

4. Circuit Breakers Designed for Machine-Driven Markets

Modern markets require faster, more adaptive circuit breakers that respond to:

-

Sudden liquidity gaps

-

Abnormal quote-to-trade ratios

-

Algorithmic runaway behavior

These “smart circuit breakers” should operate at machine, not human, speed.

5. International Coordination on AI Risk

Coordinated global frameworks or supervisory colleges could oversee AI-driven liquidity across jurisdictions.

The Future of AI in Markets: Opportunity and Systemic Uncertainty

Autonomous Trading and Self-Learning Risk Models

In the coming years, AI systems will evolve to:

-

Build their own trading models

-

Optimize strategies without human intervention

-

Coordinate across asset classes autonomously

-

Interact with other AIs in emergent patterns

These advances promise substantial efficiency, but they also introduce new forms of systemic risk that are not yet understood.

The Ultimate Question: Can the Alpha Generation Engine Be Contained?

The Alpha Generation Engine is accelerating market complexity faster than regulatory frameworks can adapt. Its capacity to generate alpha is substantial—but so is its potential to generate instability if left unchecked. The next decade will determine whether AI becomes a stabilizing force in global capital markets or a source of accelerating systemic fragility.

Conclusion

AI and algorithmic trading have redefined how global markets operate. They enhance efficiency, liquidity, and predictive power but simultaneously introduce high-velocity risks that can propagate through markets in unpredictable ways. Understanding and addressing the systemic vulnerabilities of the Alpha Generation Engine is now a critical priority for policymakers, institutions, and market participants. With thoughtful governance, technological oversight, and coordinated regulation, markets can leverage the benefits of AI while mitigating the extraordinary risks embedded in autonomous trading systems.