The Shadow Banking Surge: Assessing Systemic Risk and Regulatory Oversight in Non-Bank Lending Post-2008

Introduction

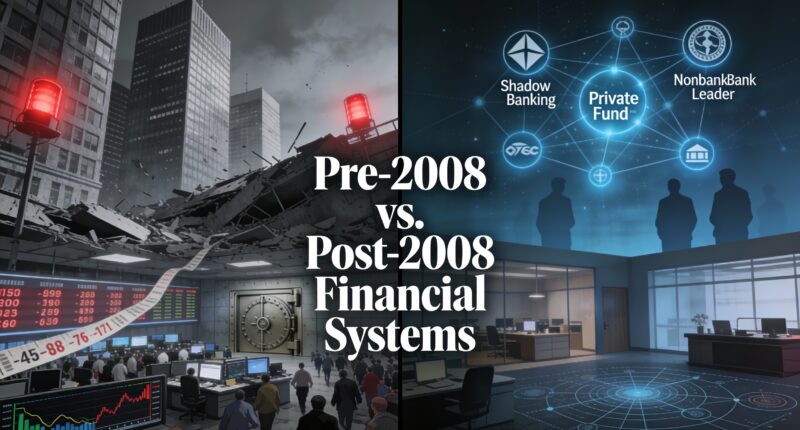

Since the 2008 global financial crisis, the structure of the global financial system has undergone a profound transformation. Traditional banks, once the dominant providers of credit, have retreated in many jurisdictions under the weight of stricter capital requirements, liquidity rules, and supervisory scrutiny. Filling this vacuum has been a rapidly expanding ecosystem of non-bank financial intermediaries—commonly referred to as shadow banking. While these entities often provide valuable credit and market liquidity, their growth has raised persistent concerns about systemic risk, regulatory arbitrage, and financial stability.

This article examines the post-2008 surge in shadow banking, analyzes the sources of systemic risk embedded in non-bank lending, and evaluates the adequacy of regulatory oversight frameworks that have emerged over the past decade and a half.

Understanding Shadow Banking

Defining Shadow Banking

Shadow banking broadly refers to credit intermediation activities conducted outside the traditional, regulated banking system. Unlike commercial banks, shadow banking entities typically do not take insured deposits or have direct access to central bank liquidity facilities. Nevertheless, they perform bank-like functions such as maturity transformation, liquidity transformation, and leverage.

Key shadow banking participants include:

- Money market funds (MMFs)

- Hedge funds and private credit funds

- Structured investment vehicles (SIVs)

- Asset-backed commercial paper (ABCP) conduits

- Mortgage finance companies

- Peer-to-peer and fintech lenders

Pre-2008 Role in the Financial Crisis

Prior to 2008, shadow banking was a critical amplifier of systemic risk. Highly leveraged off-balance-sheet vehicles funded long-term, illiquid assets with short-term wholesale funding. When confidence collapsed, these structures faced rapid runs, transmitting stress across global financial markets. The crisis revealed that systemic risk could migrate outside traditional banks while remaining deeply interconnected with them.

The Post-2008 Regulatory Shift

Tightening of Bank Regulation

In response to the crisis, regulators implemented sweeping reforms targeting banks, including:

- Basel III capital and leverage requirements

- Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR)

- Stress testing and resolution planning

- Restrictions on proprietary trading

While these measures improved bank resilience, they also increased the cost of balance-sheet lending. As a result, credit intermediation migrated toward less-regulated non-bank channels.

Regulatory Arbitrage and Credit Migration

Shadow banking growth has been partly driven by regulatory arbitrage. Activities constrained within banks—such as leveraged lending, structured credit, and real estate finance—re-emerged within private funds and non-bank lenders. In many cases, banks retained economic exposure through warehousing, distribution, or financing relationships, preserving interconnectedness despite apparent de-risking.

Drivers of the Shadow Banking Surge

Investor Demand for Yield

Persistently low interest rates following the crisis fueled investor demand for higher-yielding assets. Pension funds, insurers, and sovereign wealth funds increasingly allocated capital to private credit and alternative lending strategies that promised enhanced returns relative to public fixed income markets.

Private Credit and Direct Lending

Private credit funds have become a central pillar of post-2008 shadow banking. These funds provide direct loans to middle-market companies, real estate projects, and leveraged buyouts—often with fewer covenants and less transparency than traditional bank loans.

Key characteristics of private credit include:

- Illiquid loan structures

- Mark-to-model valuation practices

- Limited redemption windows

- High reliance on leverage at the fund or portfolio company level

Technological Innovation and Fintech

Fintech platforms have further expanded non-bank lending. Marketplace lenders and embedded finance models use data analytics and digital distribution to originate consumer and SME loans outside the banking perimeter. While technology has improved efficiency and access to credit, it has also introduced new risk vectors related to underwriting standards, data governance, and operational resilience.

Systemic Risk Implications

Liquidity Mismatch and Run Risk

A core systemic risk within shadow banking is liquidity mismatch. Many non-bank lenders fund long-term or illiquid assets with short-term or redeemable liabilities. During periods of market stress, investors may demand redemptions, forcing asset sales at distressed prices and amplifying market volatility.

The 2020 COVID-19 market turmoil provided a clear illustration, as money market funds and bond funds experienced severe liquidity strains that required central bank intervention.

Leverage and Procyclicality

Although shadow banks are often perceived as less leveraged than pre-crisis banks, leverage has not disappeared—it has been redistributed. Leverage may exist through:

- Fund-level borrowing

- Derivatives exposure

- Portfolio company leverage

In benign conditions, leverage boosts returns. In downturns, it accelerates deleveraging and asset fire sales, reinforcing procyclical dynamics.

Interconnectedness with the Banking System

Despite operating outside the regulatory perimeter, shadow banking entities remain tightly linked to banks. Banks provide financing, derivatives, custody, and prime brokerage services to non-bank lenders. Stress in shadow banking can therefore transmit back to the regulated banking sector, undermining the very stability reforms sought to achieve.

Regulatory Oversight and Policy Responses

Expansion of the Regulatory Perimeter

Global regulators, led by the Financial Stability Board (FSB), have attempted to improve oversight of non-bank financial intermediation. Measures include:

- Enhanced data collection on non-bank leverage and liquidity

- Reforms to money market fund structures

- Margin and collateral requirements for derivatives

However, regulatory coverage remains uneven across jurisdictions and sectors.

Limits of Activity-Based Regulation

Most post-crisis reforms have focused on activity-based regulation rather than entity-based supervision. While this approach aims to address risks wherever they arise, it often struggles to keep pace with financial innovation. Activities migrate, structures evolve, and regulatory blind spots persist.

Central Bank Backstops and Moral Hazard

One of the most contentious issues is the implicit extension of central bank support to shadow banking. During periods of stress, central banks have repeatedly intervened to stabilize non-bank markets, raising concerns about moral hazard. If market participants expect public support, risk-taking incentives may increase over time.

The Future of Shadow Banking Regulation

Toward a System-Wide Risk Framework

Addressing shadow banking risks requires a system-wide perspective that recognizes interconnectedness and endogenous risk. Policymakers are increasingly focused on:

- Macroprudential tools for non-banks

- Liquidity management standards for open-ended funds

- Stress testing beyond the banking sector

Balancing Innovation and Stability

Non-bank lending plays a vital role in supporting economic growth, particularly where banks are constrained. The regulatory challenge is not to eliminate shadow banking, but to ensure it operates within a framework that limits systemic externalities while preserving market efficiency.

Data, Transparency, and Global Coordination

Improved data transparency is essential for effective oversight. Regulators must close information gaps related to leverage, liquidity, and counterparty exposures. Given the global nature of capital markets, international coordination will remain critical to prevent regulatory fragmentation and arbitrage.

Conclusion

The post-2008 surge in shadow banking reflects both the success and the unintended consequences of bank-centric regulatory reform. Non-bank lenders have become indispensable providers of credit and liquidity, yet they also represent a growing source of systemic risk. Episodes of market stress have demonstrated that financial stability cannot be secured solely by regulating banks.

As shadow banking continues to evolve, regulators face a complex trade-off between fostering innovation and safeguarding systemic resilience. Effective oversight will depend on expanding the regulatory lens beyond institutional boundaries, strengthening macroprudential tools, and acknowledging that in modern financial systems, risk rarely disappears—it merely changes form.