Introduction: From Tools to Economic Actors

The global economy is entering a new phase of AI adoption often described as the agentic economy—an environment in which autonomous AI agents do not merely assist human workers but act with delegated authority to plan, decide, execute, and optimize tasks across organizations. Unlike earlier generations of software automation or generative AI copilots, agentic systems can coordinate workflows, interact with other agents, negotiate constraints, and operate continuously with minimal human intervention.

This shift has profound macroeconomic implications, particularly for professional service labor markets—including law, accounting, consulting, finance, engineering, marketing, healthcare administration, and software development. These sectors historically relied on human judgment, credentialing, and billable hours. Autonomous AI agents challenge each of those foundations simultaneously.

This analysis examines how the agentic economy is reshaping labor demand, productivity, wage structures, firm organization, and competitive dynamics at scale.

Defining the Agentic Economy

What Are Autonomous AI Agents?

Autonomous AI agents are software entities capable of:

- Decomposing high-level objectives into executable tasks

- Making decisions under uncertainty

- Interacting with APIs, databases, tools, and other agents

- Learning from feedback and adjusting strategies

- Operating asynchronously and continuously

Crucially, these agents act on behalf of organizations or individuals, not merely in response to prompts. In economic terms, they function as semi-independent productive units.

How Agentic AI Differs From Prior Automation Waves

Previous automation waves focused on:

- Repetitive, rules-based tasks

- Back-office processes

- Narrow operational efficiency

Agentic AI expands automation into:

- Knowledge work

- Strategic analysis

- Client-facing deliverables

- Multi-step professional judgment

This marks a transition from task automation to role fragmentation and recomposition.

Professional Services as Ground Zero

Why Professional Services Are Highly Exposed

Professional service industries share several characteristics that make them especially vulnerable to agentic disruption:

- High labor cost intensity

- Codified knowledge bases (laws, standards, frameworks)

- Document-heavy workflows

- Repeatable analytical patterns

- Billing models based on time rather than outcomes

Autonomous agents excel in precisely these environments.

Early Adoption Signals

Already visible trends include:

- AI agents drafting legal contracts, compliance memos, and discovery summaries

- Autonomous accounting agents performing reconciliations, audits, and tax preparation

- Consulting agents conducting market analysis, slide generation, and benchmarking

- Financial agents monitoring portfolios, executing trades, and managing risk

- Software agents writing, testing, and deploying code

While humans still supervise outcomes, the labor content per unit of output is falling rapidly.

Macro Labor Market Impacts

Declining Demand for Junior and Mid-Level Roles

The most immediate labor market impact is a sharp reduction in demand for:

- Junior analysts

- Associate consultants

- Paralegals

- Audit associates

- Entry-level developers

These roles traditionally performed information gathering, formatting, and first-pass analysis—tasks now handled efficiently by agents.

At the macro level, this creates a hollowing-out effect in professional career ladders, disrupting talent pipelines and apprenticeship models.

Polarization of High-Skill Labor

As routine cognitive work is automated, remaining human labor concentrates at two poles:

- Elite oversight and judgment roles (partners, principals, senior architects)

- Client relationship and trust-based roles

This leads to wage polarization:

- Premium compensation for scarce human judgment

- Compression or decline in wages for standardized knowledge work

In economic terms, agentic AI increases the returns to extreme skill differentiation.

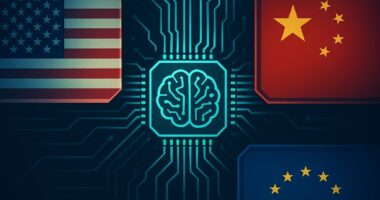

Geographic Decoupling of Services

Autonomous agents reduce the importance of labor location. Firms can deploy AI agents globally without regard to time zones, visas, or local labor markets.

This accelerates:

- Offshoring without offshoring workers

- Reduced arbitrage benefits of low-cost human labor markets

- Competitive pressure on professional service hubs

National labor markets become more exposed to global AI-driven competition.

Productivity, Growth, and GDP Effects

Short-Term Productivity Surge

At the macro level, agentic AI drives significant gains in labor productivity:

- Faster project turnaround times

- Lower marginal cost of analysis

- Higher output per professional

This can temporarily boost GDP growth, particularly in service-heavy economies.

Medium-Term Employment Adjustment

However, productivity gains do not automatically translate into net job creation. In professional services, demand is relatively income-elastic but not unlimited.

As a result:

- Output increases faster than employment

- Total hours worked decline

- Employment growth lags productivity growth

This mirrors historical patterns seen in manufacturing automation—but applied to white-collar labor.

Firm-Level Scale Effects

Agentic systems allow small teams to operate at scale, reducing the minimum efficient size of firms. Boutique firms equipped with AI agents can now compete with large incumbents.

This increases:

- Market entry

- Competitive intensity

- Pressure on legacy pricing models

At the same time, top platforms that control agent infrastructure may experience winner-take-most dynamics.

Changing Firm Organization and Business Models

From Pyramid Structures to Diamond Models

Traditional professional service firms rely on pyramidal staffing: many juniors supporting few seniors.

Agentic AI inverts this structure into a diamond model:

- Narrow junior layer

- Wide agent layer

- Concentrated senior oversight

This fundamentally alters cost structures, promotion paths, and partnership economics.

Outcome-Based Pricing and Value Capture

As billable hours lose relevance, firms shift toward:

- Fixed-fee engagements

- Outcome-based pricing

- Subscription service models

AI agents make costs more predictable, but also expose pricing power to competition.

The macro implication is margin compression across standardized services, with value migrating to bespoke, high-stakes advisory work.

Regulatory and Institutional Frictions

Licensing and Accountability Gaps

Professional services are heavily regulated. Agentic AI raises unresolved questions:

- Who is liable for agent errors?

- Can AI-generated work meet professional standards?

- How are ethical obligations enforced?

In the short term, regulation slows adoption. In the long term, regulatory frameworks are likely to adapt, legitimizing agentic participation.

Education and Credential Mismatch

Educational systems continue to produce graduates trained for roles that are rapidly disappearing.

Macro risks include:

- Graduate underemployment

- Credential inflation

- Rising social pressure for retraining and reskilling

Governments face increasing demand to realign education with an agent-augmented economy.

Distributional and Inequality Effects

Capital Versus Labor Share

Agentic AI shifts income distribution toward:

- Owners of AI infrastructure

- Firms controlling proprietary data

- Capital investors in AI platforms

Labor’s share of income in professional services declines unless workers capture complementary value.

Intergenerational Effects

Younger cohorts are disproportionately affected due to reduced entry-level opportunities. Older, established professionals may initially benefit from leverage but face long-term obsolescence risks.

This creates intergenerational inequality within professions, with political and social consequences.

Strategic Implications for Policymakers and Firms

Policy Priorities

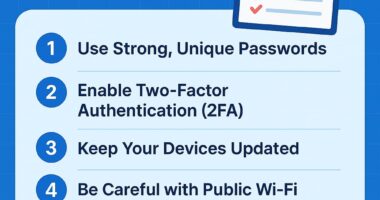

Governments must address:

- Labor market transition support

- Continuous education and credential reform

- AI accountability frameworks

- Competition policy for agent platforms

Failure to adapt risks structural unemployment in white-collar sectors.

Firm-Level Strategy

Professional service firms must:

- Redesign talent models

- Invest in proprietary agent workflows

- Differentiate through human judgment and trust

- Reprice services based on outcomes, not effort

Those that delay will face rapid margin erosion.

Conclusion: A Structural, Not Cyclical, Shift

The agentic economy represents a structural transformation of professional service labor markets, not a temporary efficiency cycle. Autonomous AI agents act as economic participants that fundamentally alter how value is created, priced, and distributed.

At the macro level, the impact includes higher productivity, labor displacement, wage polarization, and intensified competition. The challenge for economies is not whether agentic AI will reshape professional services—it already is—but whether institutions, firms, and workers can adapt quickly enough to capture its benefits while managing its disruptive costs.

In this sense, the agentic economy is less about replacing humans and more about redefining what economically valuable human work actually is.