If you had told me a couple of years ago that I’d be managing my monthly budget through a necklace or a pair of sunglasses, I probably would’ve laughed. But walking through the halls of CES 2026 this week, it became crystal clear: the era of pulling out your phone to check your bank balance is officially dying. We are entering the age of “Invisible Finance.”

The Rise of the AI Pendant: Your Budget, Now Wearable

Let’s talk about the AI Pendant 2026 trend. Companies like Plaud and Samsung are moving away from the “AI Pin” disasters of the past and focusing on something much simpler: listening and seeing. These pendants aren’t just voice recorders anymore. They are integrated with your banking apps via Agentic AI.

Imagine this: You’re at a tech shop, looking at a new monitor. Your pendant’s camera recognizes the item, cross-references it with your actual remaining budget for the month, and whispers in your ear (via bone conduction), “Ethan, if you buy this, you won’t have enough for that weekend trip you planned.” It’s high-tech discipline, and honestly, it’s the impulse buying solution we’ve all been waiting for.

Smart Glasses: The HUD for Your Financial Life

While pendants are great, the Smart Glasses for Finance are the real showstoppers. The glasses we saw this year finally look like… well, glasses. No more bulky frames. But when you look at a price tag or a QR code for a payment, a small, non-intrusive heads-up display (HUD) shows you exactly how that purchase fits into your financial goals.

This is real-time expense tracking AI at its peak. We’re moving away from manual entry (which let’s be real, nobody does consistently) to a system where your life is automatically categorized as you live it. Your glasses “see” the grocery receipt and immediately update your “Home & Food” category in your finance app. No apps, no typing, no friction.

Why 2026 is the Year of “Agentic Finance”

The keyword of the year is definitely Agentic AI. Unlike the chatbots of 2024 that just answered questions, 2026’s AI agents act on your behalf. These AI financial advisors can now negotiate lower rates on your bills or automatically move money into high-yield savings accounts based on your wearables’ data.

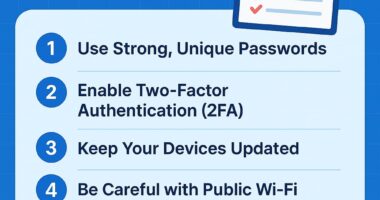

- Proactive Warnings: Your wearable knows your patterns. It can sense a high-spending weekend coming and suggest adjustments early.

- Seamless Payments: With biometrics integrated into rings and glasses, “paying” is becoming a gesture, but with the AI agent acting as a filter to ensure you aren’t overspending.

- Contextual Awareness: It knows you’re at a grocery store vs. a luxury boutique and adjusts its “advice” accordingly.

The Privacy Elephant in the Room

I know what you’re thinking—because I thought it too. “Do I really want a pendant ‘watching’ my every move?” Privacy is the biggest hurdle for CES 2026 gadgets. However, the shift this year is toward “On-Device Processing.” Most of these new devices don’t send your video or audio to the cloud; the AI lives locally on the chip. This is a massive win for security and a reason why Google AdSense advertisers are betting big on this niche.

Final Thoughts: Is Your Wallet Ready?

Transitioning to these personal finance tech gadgets might feel weird at first. But just like we got used to paying with our phones, we’ll get used to our glasses helping us save for retirement. The 2026 market isn’t just about “smart” things; it’s about “wise” things. It’s about using Artificial Intelligence to bridge the gap between our impulsive desires and our long-term financial health.

What do you think? Would you trust a wearable to tell you “no” at the checkout counter? Let’s discuss in the comments below!

Related Reading: Check out our analysis on Beyond Paytm: Top 5 High-Growth Fintech Stocks to Watch After the 2026 Market Correction to see where the smart money is moving next.

1 comment