I remember a time when we used to joke about “one ring to rule them all.” Fast forward to early 2026, and that joke has become a reality in the financial world. If you walk into a coffee shop in any major city today, you’ll see fewer people pulling out their iPhones or Samsung Ultras. Instead, they’re just tapping their knuckles against the payment terminal.

1. Why the Shift from Screens to Rings?

You might be asking, “Why do I need a ring when I have a smartwatch?” It’s a fair question. From my experience, it comes down to two things: Friction and Discretion. Smartwatches are great, but they are bulky and require frequent charging. In 2026, the sensors in smart rings have become so efficient that they last for weeks, not days.

Moreover, the Human Layer of technology is moving toward “Invisibles.” We want the power of AI and secure payments without a glowing screen constantly begging for our attention. A smart ring sits quietly on your finger, ready to verify your identity through your unique bone structure or heart rate variability (HRV)—factors that are much harder to spoof than a simple fingerprint on a phone screen.

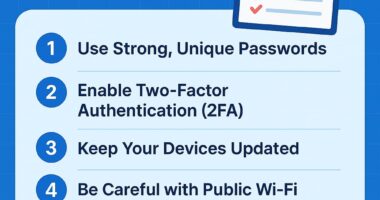

2. The Security Game-Changer: Biometrics in 2026

The biggest hurdle for digital finance has always been security. In the past year, we’ve seen a surge in AI-driven phishing attacks. This is where biometric rings come in. Most of the top-tier rings today use Electrocardiogram (ECG) sensors to ensure that the person wearing the ring is actually the owner.

If someone steals your ring, it’s useless to them because it won’t detect your specific cardiac signature. This level of Cold Storage Security for your crypto and bank accounts is what’s driving the massive adoption rates we’re seeing this quarter.

3. Top 5 Biometric Rings to Watch in 2026

I. The Oura Gen 5 Financial Edition

Oura has long been the king of sleep tracking, but their 2026 “Financial Edition” is a masterpiece. It integrates directly with major DeFi protocols. I’ve found their “Dead-Man’s Switch” feature particularly impressive—if the ring doesn’t detect a pulse for a set period, it automatically locks your connected crypto wallets.

II. McLear RingPay 2.0

McLear was a pioneer, and their 2.0 version focuses heavily on Contextual Payments. Using built-in AI, the ring can suggest which of your accounts (Credit, Savings, or Crypto) is best to use for a specific purchase based on current exchange rates and rewards.

III. Samsung Galaxy Ring Pro (2026)

Samsung has brought the “ecosystem” power to your finger. The Ring Pro acts as a physical 2FA (Two-Factor Authentication) key for every device in your home. It’s the ultimate bridge between Personal Finance Technology and the Internet of Things (IoT).

IV. Tokenize X1: The Crypto Powerhouse

If you’re a heavy crypto trader, the X1 is for you. It features a tiny, invisible e-ink display on the inner band that only shows your balance when it senses your specific skin conductivity. It’s essentially a Ledger Nano that you never have to take off.

V. Ultrahuman Air: The Minimalist’s Choice

For those who hate the “techy” look, the Ultrahuman Air is indistinguishable from a wedding band. But don’t let the look fool you—it houses a sophisticated AI that monitors your “Financial Stress” levels, nudging you to stop impulsive spending when your cortisol levels are high.

4. Integrating Smart Rings into Your Personal Finance Strategy

So, how do you actually start? I wouldn’t recommend jumping in headfirst without a plan. First, ensure your primary bank supports Tokenized Wearable Payments. Most major banks in 2026 do, but some smaller credit unions are still catching up.

Secondly, use the ring as your “Daily Driver” for small to medium transactions, but keep your high-value assets in a multi-signature wallet that requires both your ring and a biometric scan from your phone. This “layered” approach is the gold standard for security right now.

5. The Future: Where Do We Go From Here?

We are just scratching the surface. By 2027, I expect we will see these rings interacting with Central Bank Digital Currencies (CBDCs) globally. The convenience is undeniable, but as I always tell my readers: technology is a tool, not a savior. Always stay informed about the privacy terms of these wearable companies.

Final Thoughts

The Smart Ring Revolution isn’t just about showing off a cool gadget. It’s about taking back control of our digital lives. It’s about making sure that your money—whether it’s Bitcoin or USD—is as close to you as your own skin.

If you’re still carrying a bulky leather wallet, 2026 might be the perfect time to let it go. Your finger already has the key to your financial future; you just need the right ring to unlock it.

Stay savvy, stay secure.

Related Articles:

Check out our previous guide on: 5 AI Side Hustles in 2026: Building Passive Income with Generative AI

3 comments

Nbetmexico… Hecho en Mexico? Good! They’ve got some cool localized games. Customer service was helpful when I had a question. I’ll be back: nbetmexico