The gap between technology and traditional finance is closing fast. While human advisors still hold the keys to complex emotional planning, 2026 is seeing a surge in “AI Financial Twins”—autonomous agents that manage daily wealth with sub-second precision. It’s no longer about replacing humans; it’s about a massive shift toward efficiency and private, AI-driven management.

1. The Rise of the AI Financial Twin: Beyond Automation

In 2026, an AI Financial Twin is more than an app; it’s a personalized digital reflection of your financial identity. Unlike the static algorithms of the past, these twins use Secure Agentic Frameworks to act on your behalf. They don’t just alert you to overspending—they proactively move funds to higher-yield accounts based on real-time market fluctuations.

A key driver here is the Model Context Protocol (MCP), which allows these agents to securely interface with banks without the user ever sharing their primary passwords with a third-party server.

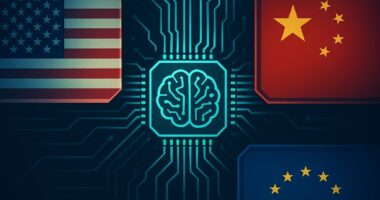

2. Understanding the Strategic Pivot in 2026

Why is the market leaning so heavily toward AI-integrated management? It’s not about “firing” humans, but about filling the gaps that traditional firms can’t reach:

- 24/7 Real-Time Optimization: Markets don’t sleep, and neither does your AI Twin. It handles tax-loss harvesting and portfolio rebalancing while you sleep.

- Privacy-First Advice: Many 2026 investors prefer a “Zero-Knowledge” AI that can analyze sensitive data locally on their own hardware, away from the prying eyes of large corporations.

- Democratization of Elite Strategies: Strategies once reserved for high-net-worth individuals are now accessible via a $15-$25/month AI subscription.

3. The 2026 Gadget Ecosystem: Powering Your Financial Twin

To truly leverage a Financial Twin, the modern investor is moving toward an “Experience Collage” of connected gadgets that make the AI tangible.

A. Local AI Privacy Nodes

Rather than trusting the cloud, many are installing small desktop “Privacy Nodes.” These devices run your AI Twin locally, ensuring your bank balances and trade history stay inside your home.

B. Biometric Verification Rings

In 2026, your AI Twin suggests a trade, but you authorize it with a simple tap of your smart ring. This biometric “human-in-the-loop” layer prevents accidental or unauthorized AI actions.

C. Next-Gen Wearable Dashboards

Smart glasses and AR overlays now allow investors to see their “Financial Health Score” in their field of vision, providing subtle nudges when they are about to make a purchase that exceeds their AI-calculated budget.

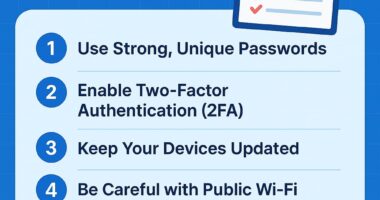

4. Navigating the Risks: Security and Oversight

The transition isn’t without hurdles. “Algorithmic Drift” remains a concern where an AI might become too conservative or too aggressive over time. This is why the 2026 **EU AI Act** and other global standards now require a “Manual Override” for all financial agents. Security is paramount, and the best AI Twins are those that prioritize biometric anchoring.

Final Thought: A Hybrid Future

The future of wealth management isn’t a world without humans—it’s a world where humans are supercharged by their AI counterparts. Whether you’re a Gen Z investor starting your first portfolio or a seasoned veteran, the “AI Financial Twin” is becoming the most powerful tool in the 2026 financial arsenal.

– Ethan Cole (Technology & Financial Strategy Analyst)

Stay Secure:

🛡️ Deep Dive: Is Your AI Assistant Leaking Financial Data? (2026 Audit)

2 comments

Share our offers and watch your wallet grow—become an affiliate!