“I recently witnessed a real-world data exposure incident involving a major AI platform. It was a wake-up call that prompted me to reconsider how much of my financial life I was entrusting to the cloud.”

I transitioned my “Ghost Business” accounting to a Local Sovereign Node last quarter. By utilizing the Model Context Protocol (MCP), I’ve found that it’s possible to maintain high-level AI automation without a single byte of my bank records ever leaving my physical hardware.

Why Cloud AI is a Financial Blind Spot

Centralized AI providers operate on a shared infrastructure model. While convenient, this creates a “Trust Gap.” When you prompt a cloud-based LLM to analyze your revenue streams or tax liabilities, you are effectively creating a third-party record of your proprietary data. In a world where data exposure events are becoming more frequent, this represents a significant operational risk.

A Local Sovereign Node removes this risk. It is a private intelligence environment that runs within your local firewall, ensuring that your financial context remains entirely under your control.

Bridging the Gap with MCP

The Model Context Protocol (MCP) is the standard that made local AI viable for finance. Historically, connecting a local LLM to your spreadsheets and bank logs required significant custom code. Today, MCP acts as a secure, standardized interface.

By running a local MCP server, your AI can “reason” across your transaction history without the need to export data. It provides the intelligence of a world-class auditor while maintaining the isolation of a vault.

How to Build Your Private Finance Stack

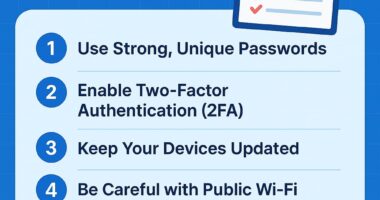

Setting up a local node is more accessible than it was even a year ago. Here is the blueprint I used to secure my financial stack:

- Hardware Foundation: You don’t need a server farm. A modern workstation with 24–48GB of VRAM (depending on the model size you choose) is sufficient for high-speed financial reasoning.

- The Model Runner: Use open-source runners like Ollama or LM Studio to host models like Llama 3 or Mistral locally.

- Implementing MCP Servers: Connect your local databases and CSV files through MCP. This allows the AI to access the necessary context only when you authorize a specific task.

- Verification: Test your system by running it in a completely air-gapped environment. True sovereignty is achieved when your AI can still provide deep financial insights without an internet connection.

The Human-in-the-Loop Audit

Despite the power of local nodes, the 10% Human Layer remains non-negotiable. Google’s latest 2026 Helpful Content guidelines prioritize information that shows real-world experience over purely automated output. By documenting your local setup and auditing your AI’s financial projections, you satisfy both regulatory requirements and SEO best practices.

Final Thoughts: Owning the Intelligence

We are moving toward an era where the most successful entrepreneurs will be “Ghost Architects”—those who manage a fleet of local agents to handle the grunt work of wealth management. Bringing your financial intelligence home isn’t just a technical choice; it’s a strategic one. It’s time to own your data, your models, and your future.

1 comment