I remember back in 2021 when people were losing their minds over $1,000 smartphones. We thought we had reached the peak of “tech inflation.” Fast forward to today, January 4, 2026, and I’m looking at price tags that make a down payment on a car look reasonable. If you’ve walked into a tech store lately or scrolled through Amazon, you’ve probably felt that sudden sting in your wallet.

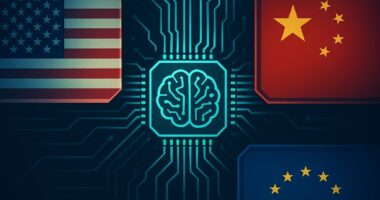

The truth is, the smartphone market has fundamentally shifted. We aren’t just paying for a slab of glass and metal anymore. We are paying for a massive global power struggle involving AI, chip shortages, and a complete overhaul of how mobile devices work. If you’re planning to upgrade this year, you need to know what’s actually happening behind the scenes. This isn’t just “corporate greed”—it’s a perfect storm of three major factors.

1. The “AI Tax”: Why Silicon is the New Gold

The biggest culprit is sitting right inside the phone: the processor. In 2026, every major manufacturer—Apple, Samsung, Google, and Xiaomi—is obsessed with “On-Device AI.” Gone are the days when AI was just a fancy word for better portrait photos. Today, your phone is expected to translate real-time conversations, edit complex videos via voice commands, and run personal LLMs (Large Language Models) without needing an internet connection.

To do this, phones now require massive Neural Processing Units (NPUs) and a staggering amount of RAM. Remember when 8GB of RAM was “pro”? In 2026, 16GB is the bare minimum for a decent AI experience, and 24GB is becoming the standard for flagships. The cost of manufacturing these high-density memory chips has skyrocketed because everyone—from car makers to military contractors—is fighting for the same silicon. When you buy a phone today, you’re essentially paying a “premium tax” for the high-end hardware needed to run your AI assistant locally.

2. The Invisible Energy Crisis and Logistics

Last year, we talked about how Big Tech was buying up nuclear power plants. Well, that has a direct ripple effect on your pocket. The massive data centers powering our digital lives are consuming so much electricity that the cost of manufacturing tech components has increased across the board. Every factory in Taiwan, South Korea, and the US is facing higher operational costs due to the global energy transition.

Moreover, the logistics of 2026 are more complicated than ever. We’ve moved toward a more “decentralized” supply chain to avoid the bottlenecks of the early 2020s, but that resilience comes with a price. Shipping a smartphone from a factory in India or Vietnam to your doorstep now involves higher carbon taxes and specialized handling for the new, more volatile solid-state batteries that are starting to hit the market. These costs don’t just disappear; they get added to your final checkout price.

3. The Death of the “Cheap” Flagship

I’ve been tracking this for a while, and it saddens me to say: the “Budget Flagship” is officially dead. Companies have realized that the middle ground is a losing game. They are now pushing users toward “Ultra” and “Foldable” tiers because that’s where the profit margins are. The base models are being stripped of features to keep the price *looking* lower, but if you want a phone that will actually last four years, you’re forced into the $1,500+ bracket.

How to Outsmart the Market (My Personal Recommendations)

So, does this mean you should just give up and keep your cracked iPhone 12 forever? Not necessarily. Here is how I’m personally navigating the 2026 tech market without going broke.

A. Skip the “Brand New” Hype Cycle

We are just days away from CES 2026. Every influencer is going to tell you that the new “AI-Glass 7” is a must-buy. Ignore them. The smartest move right now is to look for “Last Gen Plus” devices. A flagship from late 2024 or early 2025 still has enough NPU power to handle 90% of the AI tasks you actually need. You can often find these refurbished or on clearance for 40% less than the 2026 models.

B. Prioritize “Repairability” Over “Thinness”

With prices this high, a phone needs to be a 5-year investment, not a 2-year toy. Look for brands that have committed to 7 years of security updates and easy battery replacements. If you’re paying $1,400 for a phone, you better be able to swap the battery for $50 in three years instead of buying a whole new device.

C. Use Trade-in Cycles Aggressively

The only way to win the 2026 price game is to never let your current phone’s value drop to zero. I’ve found that trading in a device every 2 years—while it still holds 50% of its original value—is actually cheaper in the long run than keeping a phone for 5 years until it’s worth $20. Set a calendar reminder: when your phone hits the 24-month mark, check the trade-in subsidies. In 2026, carriers are desperate to keep you on their 6G plans, so they are offering insane trade-in credits just to lock you into a contract.

Conclusion: A New Era of Value

We have to change our mindset. A smartphone in 2026 isn’t just a phone; it’s your primary computer, your AI secretary, and your professional camera. While the price hike hurts, the utility we get is undeniably higher than it was a decade ago. However, being a “smart” consumer in 2026 means seeing through the marketing fog.

Don’t buy the hype. Buy the hardware that fits your life. If you don’t need a phone that can generate 4K VR environments on the fly, don’t pay for the chip that does it. The era of the “blind upgrade” is over. Welcome to the era of intentional tech ownership.

If you found this breakdown helpful, consider sharing it with a friend who’s eyeing a new upgrade. For more deep dives into the 2026 tech economy, stay tuned to our weekly updates.

📖 Recommended Reading for You:

If you’re upgrading to a new AI phone to create better content, don’t miss our exclusive guide on how to maximize your revenue:

🚀 From $0.02 to $1.20: My TikTok RPM Transformation Journey (2026 Strategy)