Introduction: Why the Post-Quantum Moment Matters Now

The global financial system is built on cryptography. From interbank payments and securities settlement to digital identity and cloud-based core banking, modern finance assumes that today’s cryptographic standards will remain secure for decades. That assumption is no longer safe. Advances in quantum computing threaten to break widely deployed public-key cryptography, creating a systemic risk that rivals past financial crises in scale and complexity.

The coming transition is often described as a technical upgrade. In reality, it is a structural shift with macro-financial implications. The post-quantum pivot will determine whether financial institutions can preserve trust, continuity, and legal certainty in a world where legacy cryptography can no longer guarantee security. Managing this transition is not optional; it is a strategic necessity.

Understanding the Cryptographic Foundations of Finance

Public-Key Cryptography as Financial Infrastructure

Modern finance relies heavily on public-key cryptography, particularly algorithms such as RSA and elliptic curve cryptography (ECC). These systems underpin:

- Secure payments and messaging (e.g., SWIFT, card networks)

- Digital signatures for contracts and securities

- Authentication for customers and institutions

- Secure channels between financial market infrastructures

These algorithms are trusted because classical computers cannot efficiently solve the mathematical problems they rely on. Quantum computers change that assumption.

Why Quantum Computing Changes the Risk Model

Quantum algorithms, most notably Shor’s algorithm, can theoretically break RSA and ECC by efficiently factoring large numbers and solving discrete logarithms. While large-scale, fault-tolerant quantum computers are not yet operational, progress is steady. Financial systems, however, have long lifecycles. Data encrypted today may need to remain secure for decades.

This creates a “harvest now, decrypt later” risk. Adversaries can capture encrypted financial data today and decrypt it once quantum capabilities mature. The risk is therefore already present.

The Systemic Nature of Post-Quantum Risk

From Cyber Risk to Financial Stability Risk

Post-quantum cryptography is often framed as a cybersecurity issue. That framing is incomplete. If cryptographic trust fails at scale, the consequences extend to:

- Settlement finality disputes

- Contract enforceability challenges

- Liquidity freezes due to authentication failures

- Loss of confidence in digital financial records

These are systemic risks. They affect not just individual institutions, but entire markets.

Interconnected Institutions, Shared Vulnerabilities

Financial systems are deeply interconnected. A failure in one institution’s cryptographic controls can cascade through clearing houses, custodians, correspondent banks, and payment networks. Unlike localized cyber incidents, a cryptographic collapse would expose shared dependencies across the system.

This mirrors other systemic risks: the same cryptographic standards are used everywhere, creating a single point of failure at a global scale.

Regulatory Awareness and the Emerging Policy Response

Regulators Are Moving, Slowly

Financial regulators are increasingly aware of quantum risk, but policy responses remain uneven. Some supervisory authorities have begun to:

- Request cryptographic inventories

- Encourage quantum risk assessments

- Reference post-quantum readiness in cybersecurity guidance

However, binding timelines and enforceable standards are still rare. This creates uncertainty for institutions that must balance near-term costs against long-term resilience.

The Risk of Regulatory Lag

A delayed regulatory response increases systemic exposure. If institutions wait for formal mandates, the transition may become rushed, disorderly, and expensive. In a worst-case scenario, multiple institutions could attempt simultaneous cryptographic migrations under crisis conditions.

History suggests that proactive regulation is cheaper and more effective than reactive intervention. The post-quantum transition is no exception.

The Operational Challenge of the Post-Quantum Pivot

Cryptographic Debt in Legacy Systems

Many financial institutions operate on legacy systems built decades ago. Cryptography is often deeply embedded in application logic, hardware security modules, and third-party dependencies. This creates significant cryptographic debt.

Replacing vulnerable algorithms is not as simple as swapping libraries. It requires:

- Application refactoring

- Hardware upgrades

- Vendor coordination

- Extensive testing and validation

The scale of this effort rivals major core banking transformations.

Data Longevity and Legal Risk

Financial data has long retention requirements. Trade records, customer data, and contractual documents must remain confidential and verifiable for many years. If signatures or encryption become invalid, institutions may face legal disputes over authenticity and compliance.

Post-quantum readiness is therefore not only a technical issue, but also a legal and compliance concern.

Post-Quantum Cryptography: What Comes Next

Quantum-Resistant Algorithms

Post-quantum cryptography (PQC) refers to algorithms designed to resist quantum attacks. These include lattice-based, hash-based, and code-based schemes. Standardization efforts are underway, with several algorithms moving toward broad adoption.

However, PQC algorithms often have different performance characteristics, such as larger key sizes and higher computational overhead. Financial systems must assess their impact on latency-sensitive operations like high-frequency trading and real-time payments.

Hybrid Approaches as a Transition Strategy

Many institutions are exploring hybrid cryptographic models that combine classical and post-quantum algorithms. This approach provides defense in depth while maintaining compatibility with existing systems.

Hybrid models reduce transition risk, but they also increase complexity. Governance, key management, and operational oversight become more demanding.

Strategic Risk Management for Financial Institutions

Treating Post-Quantum Readiness as Enterprise Risk

Leading institutions are elevating post-quantum risk to the enterprise risk management level. This involves:

- Board-level oversight

- Integration into operational resilience planning

- Alignment with business continuity and disaster recovery

By framing the issue as systemic risk rather than IT risk, organizations can justify long-term investment and cross-functional coordination.

Building a Cryptographic Inventory

A foundational step is creating a comprehensive inventory of cryptographic usage across the organization. This includes:

- Algorithms and key lengths

- Data classification and retention timelines

- Third-party and vendor dependencies

Without visibility, effective migration is impossible.

Market Infrastructure and Collective Action

The Role of Financial Market Infrastructures

Clearing houses, payment systems, and central securities depositories play a critical role in the post-quantum transition. Their standards and timelines will influence the entire ecosystem.

If market infrastructures move early, they can anchor coordinated migration. If they delay, fragmentation and operational risk increase.

The Need for Industry Coordination

Post-quantum migration cannot be done in isolation. Industry working groups, shared testing environments, and common standards are essential. Collective action reduces cost, improves interoperability, and lowers systemic risk.

This is an area where industry associations and public-private partnerships can deliver outsized value.

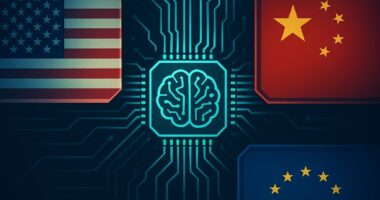

The Geopolitical Dimension of Quantum Risk

Cryptography as Strategic Infrastructure

Cryptography is no longer just a technical tool; it is a strategic asset. Nations that lead in quantum and post-quantum capabilities will shape global financial standards and influence cross-border trust.

Financial institutions operating internationally must navigate divergent regulatory approaches and geopolitical tensions related to technology sovereignty.

Fragmentation Versus Global Standards

A fragmented post-quantum landscape increases operational risk. Divergent national standards could complicate cross-border payments, custody, and compliance. Global coordination, while difficult, is economically preferable.

Preparing for an Orderly Transition

Phased Migration and Stress Testing

An orderly post-quantum pivot requires phased implementation. Institutions should:

- Prioritize high-risk systems

- Pilot post-quantum algorithms in non-critical environments

- Conduct stress testing and scenario analysis

This mirrors how financial institutions manage other forms of systemic risk.

Investing Ahead of the Crisis

The economic logic is clear. Early investment spreads cost over time and avoids crisis-driven spending. Institutions that move first will also gain competitive advantages in trust, resilience, and regulatory credibility.

Conclusion: The Post-Quantum Pivot as a Financial Imperative

The post-quantum pivot is not a distant theoretical problem. It is a foreseeable structural shock to the cryptographic foundations of finance. Left unmanaged, it could undermine trust, disrupt markets, and create systemic instability.

Managing this risk requires a shift in mindset. Financial leaders must treat cryptography as critical infrastructure, quantum risk as systemic risk, and post-quantum readiness as a strategic priority. The institutions that act decisively today will define financial stability in the quantum era.

The cryptographic collapse is not inevitable. But avoiding it will require foresight, coordination, and sustained investment. The time to pivot is now.