Navigating the Digital Payments Landscape

The fintech sector in Southeast Asia has seen explosive growth in recent years, driven by rapid digitalization and a young, tech-savvy population. Digital payments are at the core of this transformation, as consumers increasingly turn to electronic methods for transactions. The region, which includes countries like Indonesia, Malaysia, and Vietnam, is home to a diverse range of digital payment platforms. These platforms not only facilitate easier and faster transactions but also enhance financial inclusion for unbanked populations.

In 2021, Southeast Asia’s digital payments market was estimated to reach $1.2 trillion, showcasing a remarkable CAGR (Compound Annual Growth Rate) of 22.5%. This trend is propelled by advancements in mobile technology and internet penetration, with a significant proportion of the population gaining access to smartphones and 4G networks.

Key Players in the Indonesian Unicorn Market

Indonesia, as the largest economy in Southeast Asia, has become a hotspot for fintech innovation. Several key players dominate the Indonesian unicorn market, including:

| **Company Name** | **Valuation (Approx.)** | **Core Services** |

|——————|————————-|———————————-|

| Gojek | $10 billion | Ride-hailing & Payment Platform |

| OVO | $1 billion | Digital Wallet & Payment Services |

| DANA | $1 billion | E-wallet & Payment System |

These companies have redefined financial services by integrating payment solutions with ride-hailing and e-commerce. Additionally, traditional financial institutions are proactively collaborating with fintech firms to enhance their service offerings.

Revolutionizing Financial Transactions

Fintech has revolutionized financial transactions in Southeast Asia through innovations like blockchain, electronic wallets (e-wallets), and peer-to-peer (P2P) lending. The **blockchain technology** offers transparency and security for financial transactions, while **e-wallets** enable users to make payments and transfer funds seamlessly using their mobile devices.

Moreover, P2P lending platforms have emerged as significant players within the complex landscape of personal finance. They connect borrowers directly with lenders, allowing for greater access to capital for those often underserved by traditional banks. This shift towards more inclusive financial practices embodies the core ethos of the fintech movement.

The Shift Towards Mobile Wallets

Mobile wallets are leading the charge in the digital payment landscape of Southeast Asia. In 2022, it was estimated that approximately 70% of digital transactions in the region were conducted through mobile wallets, highlighting the growing reliance on this payment method.

The popularity of mobile wallets such as **GrabPay**, **GoPay**, and **LinkAja** can be attributed to their ease of use, versatility, and integration with various services. Users can make payments for everything from utilities to online shopping with just a few taps on their smartphones.

Additionally, mobile wallets have significantly reduced transaction costs, making them a favorable alternative to traditional banking. Their user-friendly interface promotes high adoption rates, especially among younger generations eager for efficient financial solutions.

Emergence of Tech Giants in the Payment Sector

Competition in the Digital Payment Industry

As fintech continues to grow, competition within the digital payment industry has intensified. Established companies like **Alibaba** and **Tencent**, along with local players, are navigating a rapidly evolving market characterized by innovation and consumer demand.

Several strategies have emerged as part of this competitive landscape, such as:

– **Offering diverse services**: Companies are expanding their service offerings beyond payments to include loans, insurance, and investment services.

– **Enhancing user experience**: Businesses are investing in user-friendly interfaces and customer support to improve customer satisfaction.

– **Localized solutions**: Understanding cultural nuances and tailoring services to regional needs has become critical for success.

The rivalry among firms fosters a continuous cycle of innovation and improvement, ultimately benefiting consumers with better services.

Innovative Solutions for Seamless Transactions

Fintech firms are consistently developing innovative solutions aimed at streamlining transactions. Notable advancements include QR code payments, biometric authentication, and AI-driven fraud detection systems that enhance both security and efficiency.

**QR code payments** allow users to execute transactions by simply scanning codes on their smartphones, reducing the need for cash and traditional cards. Meanwhile, biometric authentication, such as facial recognition or fingerprint scanning, adds a layer of security essential for consumer trust in digital payments.

AI-driven systems not only facilitate faster transactions but also track user behavior to identify and mitigate fraudulent activities. By leveraging data analytics, fintech companies can provide tailored financial products, enhancing the overall customer experience.

Partnerships Driving Growth in Fintech

Strategic partnerships are emerging as a key driver of growth within the fintech sector. Collaborations between fintech startups and established banks not only ensure resource sharing but also combine agility with experience. Notable examples include:

– **Partnerships with telecommunication firms**: This expands reach to users who rely on mobile phones for financial transactions.

– **Alliances with payment gateways**: Enhance the ability to process transactions swiftly and securely.

By pooling resources and expertise, these partnerships enable companies to innovate more rapidly and respond more effectively to market demands, solidifying their positions in a competitive environment.

Challenges and Opportunities in the Digital Payment Space

Regulatory Hurdles in Fintech Adoption

Despite the rapid growth of fintech, regulatory challenges present significant hurdles for both new and established players. Each country in Southeast Asia has its regulatory framework, creating an environment where compliance can be complex and time-consuming.

Key concerns include:

– **Data protection regulations**: Fintech firms must navigate various laws surrounding consumer data privacy.

– **Licensing requirements**: Acquiring the necessary licenses may require extensive time and financial commitment.

– **Anti-money laundering (AML) policies**: Ensuring compliance with AML laws is critical to maintain the trustworthiness of services.

Companies that effectively address these regulatory challenges stand to benefit from reduced operational risks while expanding their market reach.

Future Prospects of Cashless Economies

The trajectory towards cashless economies in Southeast Asia presents endless opportunities for growth. With the growing number of digital payments, the region’s economy is on track to become increasingly cashless.

Predictions indicate that by 2030, the cashless economy could soar to $1 trillion as more consumers benefit from convenience and security. With a potential increase in digital financial literacy, consumers will likely become more comfortable engaging with fintech solutions. Nations prioritizing infrastructure development and tech education are poised to thrive in this new landscape.

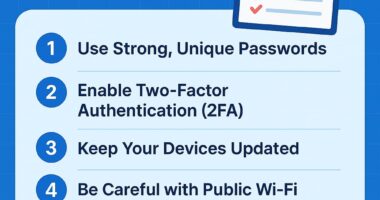

Security Concerns in Mobile Payment Systems

As mobile payment systems gain traction, security remains a paramount concern for users and providers alike. Cybersecurity threats, including data breaches and identity theft, necessitate continual investment in security measures.

Fintech companies are developing advanced encryption methods, secure authentication processes, and fraud detection systems to tackle these challenges. Consumer education on spotting phishing attempts and safeguarding personal data is imperative to foster trust and encourage continued adoption of digital payment solutions.

In conclusion, despite challenges, the rise of fintech in Southeast Asia signifies a remarkable transformation in financial services. As the industry evolves, innovation, regulation, and collaboration will shape the future of payments, creating a vibrant landscape for both consumers and businesses.

Embracing the Future of Fintech in Southeast Asia

The revolution in financial technology across Southeast Asia is not just a trend; it’s a movement reshaping how individuals and businesses manage money. By prioritizing innovation and collaboration, the region is poised to emerge as a global fintech leader, paving the way for a financially inclusive future.